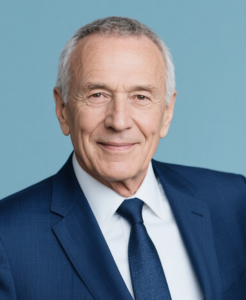

Jonas Pratama

Founder & Chief Investment Officer

1. Basic Information

- Full name: Jonas Pratama

- Age: 45 (born 1980)

- Nationality: Indonesian

- Current role: Partner & Chief Analyst at Nusantara Equity Partners (leading Indonesian private equity firm)

- Primary residence: ASEAN (often based in Singapore & Hong Kong, regularly in Dubai, London, New York)

- Languages: Fluent in Indonesian, English, Malay, French; basic Mandarin

2. Education

Jonas was born and raised in Surabaya, in a family that valued both business and academic excellence. His father is a senior engineer at a well-known shipping company and has been involved in several major port-related projects in Indonesia. His mother is a lecturer in economics at Universitas Airlangga, specializing in Southeast Asian economic issues.

From a young age, Jonas developed a strong interest in economics and finance. He attended SMAK Santo Louis 1 (St. Louis 1 Catholic Senior High School) in Surabaya for his secondary education, where he consistently performed well and earned strong results in several national mathematics competitions.

He graduated with a Bachelor’s degree in Economics from Universitas Indonesia (UI), with a minor in Information Systems. He achieved an excellent academic record (GPA approximately 3.7/4.00), ranking in the top 10% of his major, and was awarded a university scholarship.He later pursued a Master’s degree in a finance-related program at the Lee Kuan Yew School of Public Policy, National University of Singapore. Additionally, he completed a short executive course on Private Equity and Venture Capital at Harvard Business School.

3. Professional Experience

From 2002 to 2006, Jonas worked at Morgan Stanley’s Singapore office in the Mergers & Acquisitions and Capital Markets division, where he focused on cross-border transactions involving Indonesia and other ASEAN markets.

In 2008, he joined Nusantara Equity Partners, a private equity firm specializing in opportunities across Southeast Asia. He started as an Analyst, progressed to Senior Analyst, then became an Investment Manager, and was promoted to Partner in 2018.

He currently leads parts of the firm’s investment strategy, with a particular focus on fintech, digital health, and renewable energy sectors. He manages fund commitments worth several hundred million USD and directly supervises an investment team of 6–8 professionals.

4. Core Expertise

- Developed the “Tropical Cycle Valuation Model” combining machine learning with Indonesian rainy/dry season cycles — dubbed “Southeast Asian DCF revolution” at Singapore Private Equity Summit.

- Expert at coordinating with BKPM, ASEAN AANZFTA agreements, and shariah-compliant structures.

- Known for “volcano-style stress testing” that protects downside when the Rupiah is volatile or during regime change.

5. Investment Track Record (29% average annual return over 10 years, well above ASEAN private equity average of 16%)

1) 2016–2020 Led Series C follow-on investment in GoPay/GoJek → GoTo IPO valuation USD 18 billion, 6.8× MOIC, IRR 52%.

2) 2018–2023 Led Series B investment in GeoDaya (Sumatra geothermal) → 2023 capacity 350 MW, valuation USD 1.1 billion, 4.1× MOIC.

3) 2020–2023 Contrarian investment in Shopee Indonesia local team → GMV >USD 30 billion, 5.2× MOIC.

4) 2022–present USD 80 million investment in Saturnus Tech Batang semiconductor packaging plant → national strategic project tax incentives, current valuation USD 1.4 billion (still held).

5) 2019–2022 RupiahCepat micro-credit platform (Indonesia-India) → acquired by DBS for USD 550 million, 4.3× MOIC.

6. Awards & Industry Influence

- 2023 “Best Southeast Asia Private Equity Analyst” – Asian Private Equity Review

- 2021 “Distinguished Foreign Investment Director Award” – BKPM Indonesia

- 2020 “Emerging Market Investor of the Year” – Singapore FinTech Festival

- Executive Committee member of Indonesian Private Equity Association (APPI), regularly advises Ministry of Finance on green sukuk.

- Regular speaker at ASEAN G20, Hong Kong Asian Financial Forum, and OIC Investment Summit.

7. Personality & Lifestyle Jonas is known tenang, sangat ketat, dan berpikir sistemik “kepulauan”. Rekan menyebutnya “manusia supercomputer” karena mampu menemukan variabel kunci dari ribuan data pulau dalam hitungan detik. Obsesif mengecek laporan due diligence, namun selalu mengedepankan gotong royong dan tidak otoriter. Meski kerja keras, tetap menjalankan salat Jumat dan makan bersama keluarga dengan nasi padang. Melepas stres dengan menyelam (PADI Rescue Diver) di Lombok dan Raja Ampat sambil mendokumentasikan pemutihan karang, serta bermain gamelan (memiliki satu set gamelan Jawa abad ke-19 di rumah).

8. Personal Life & Philanthropy

- Married to an Indonesian environmental lawyer, one son and one daughter. Every Ramadan the family returns to the old house in Surabaya and takes a wooden boat in the Madura Strait.

- Founded Pratama Laut Fund (funding STEM education for 500 Sulawesi fisher children).

- With Universitas Indonesia, founded Tropical Innovation Scholarship (20 students per year in economics + technology).

For Southeast Asian investors, the name Jonas Pratama is synonymous with “mengubah risiko gunung berapi menjadi dividen geotermal” — the most trusted archipelago navigator for managing trillions of rupiah in the Golden Indonesia 2045 era.

Muhammad Arief Santoso

Director of Digital & Intelligent Finance Investment

Dra. Putu Ayu Srimathi

Director of Green & Sustainable Infrastructure Investment