1.2 Million Tons CO₂ Reduced

Through investment in Sarulla geothermal, Star Energy, and sustainable battery chains, we have reduced carbon emissions equivalent to 1.2 million tons by 2025 — equivalent to planting more than 20 million trees.

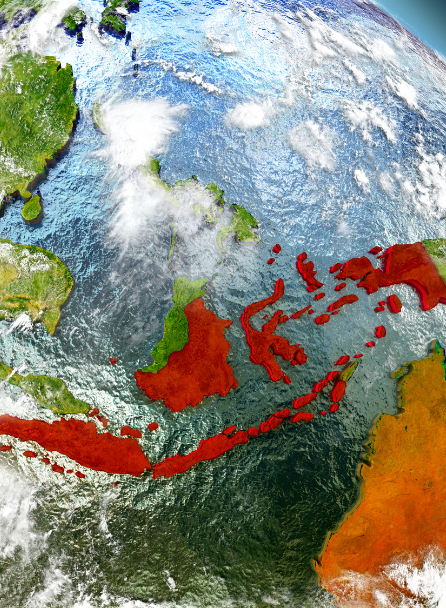

From Wall Street Discipline to the Dawn of the Indonesian Archipelago.

Aurora Archipelago Capital (AAC) was founded by Jonas Pratama in 2015, managing USD 29.5 billion in assets (September 2025). Blending 23 years of Wall Street discipline with the spirit of the Archipelago, AAC focuses on digital finance, geothermal, nickel, and green growth across Indonesia-ASEAN through “Tropical Value Framework”. Results: high returns with the lowest volatility, nearly 1 million global members, and tangible impact for 600 million ASEAN middle class.

Emerging Markets

75Indonesian Members

41Indonesian Growth

80Customer Satisfaction

96

AAC stands to be the trusted long-term capital bridge between the rising West and East. We believe the best investment is not only about returns, but also about creating real impact: lifting 600 million ASEAN middle class, accelerating Indonesia toward the world's top 5 economies by 2045 (GDP per capita > USD 25,000), and transforming a resource-exporting nation into a global investment hub.

All our strategies, products, and decisions rest on the following three pillars — this is AAC's DNA.

Through investment in Sarulla geothermal, Star Energy, and sustainable battery chains, we have reduced carbon emissions equivalent to 1.2 million tons by 2025 — equivalent to planting more than 20 million trees.

Our portfolio creates 15,000 direct jobs and more than 465,000 indirect jobs in geothermal, downstream nickel, digital infrastructure, and MSMEs — supporting inclusive growth from Java, Sumatra, to Sulawesi.

Nearly 980,000 global members, 18,000 MSME entrepreneurs, and 32,000 pesantren students have completed our value investing & micro-CFA education programs — nurturing a new generation of “investment ambassadors” across the archipelago.