Tropical Value Framework

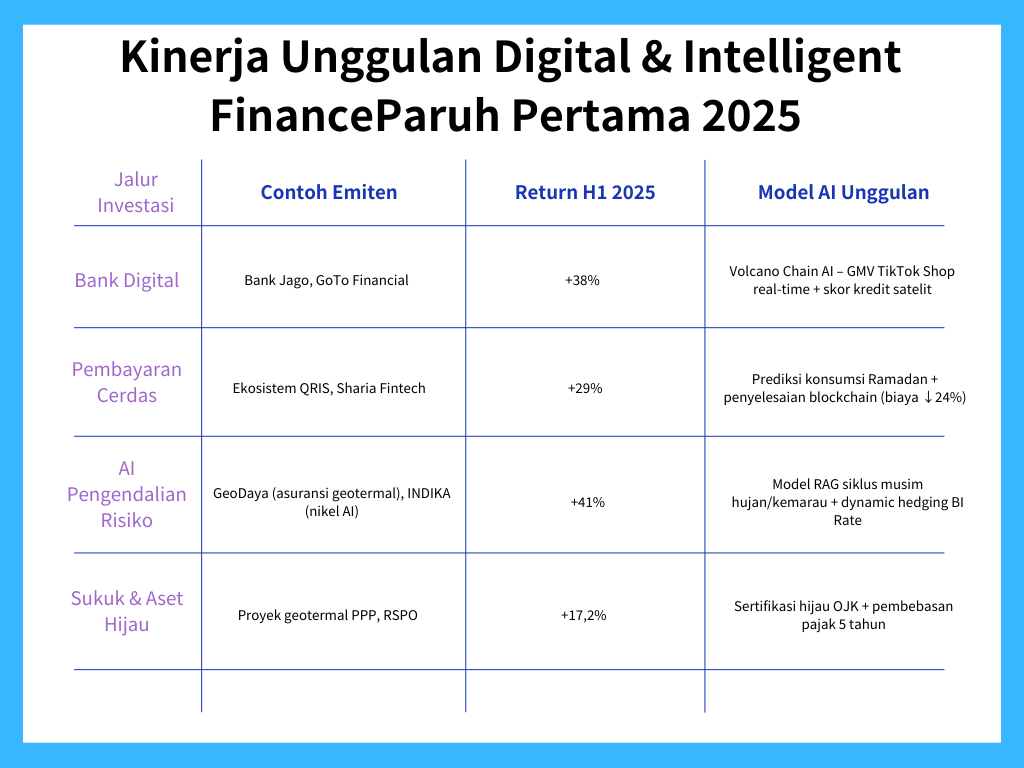

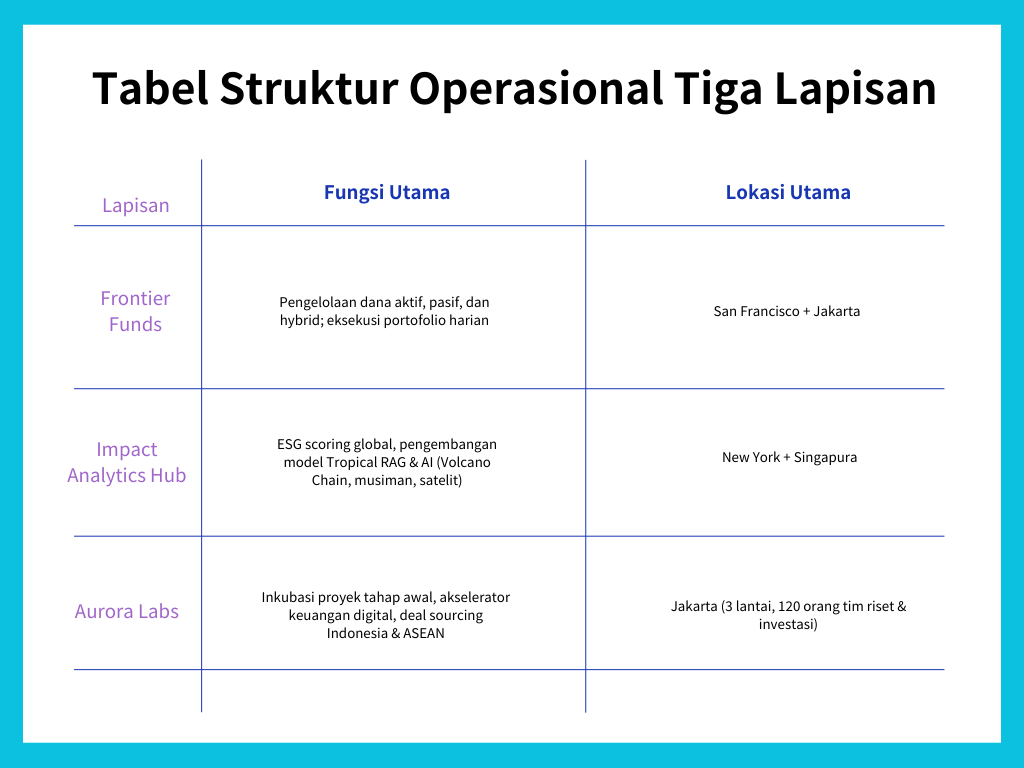

The perfect blend of Wall Street DCF with unique Indonesian variables: rainy/dry season cycles, satellite monitoring of nickel & palm oil mines, automatic 7-day BI Rate trigger, and Eid consumption prediction — delivering volatility of only 6.5% while maintaining 17.8%+ returns.